Assessing the oncology IT impact of the Siemens-Varian acquisition

May 19, 2021

By Imogen Fitt

Siemens Healthineers officially completed the acquisition of Varian Medical Systems on April 15, 2021. The two companies constitute a combined annual revenue of around $20 billion, and there’s little doubt that this decision will have raised eyebrows amongst competitors in the oncology segment when it was announced back in August 2020.

With the process now complete, in this article we explore how this move will shape the oncology IT landscape going forward and our expectations for the new expanded Siemens Healthineers.

Building better

Siemens and Varian have been working together since 2012, when the “EnVision” partnership was first established between the two vendors. Solutions such as ARIA connectivity, which enabled Varian’s IT networks to integrate seamlessly with Siemens discontinued linear accelerators, were co-developed. The partnership initially positioned both companies positively, by providing enhanced sales opportunities for new Varian hardware and software deals once linear accelerator replacements were due. This past familiarity should also translate to a relatively smooth transition going forward, though as ever with large corporate mergers of this scale, it will take time for the two firms to realize the benefits of the deal.

Both vendors will be keen to exploit the merger allowing Varian access to Siemens’ much larger operational and sale networks, particularly a broader reach across emerging markets where Siemens already has an established presence, especially in emerging Eastern Europe, Middle East, Africa and Asia Pacific markets. In more established markets, the firms are also complementary, with little overlap of Siemens’ own installed base of established customers across Europe and Varian’s strong customer base in the U.S.

Establishing a cancer care continuum

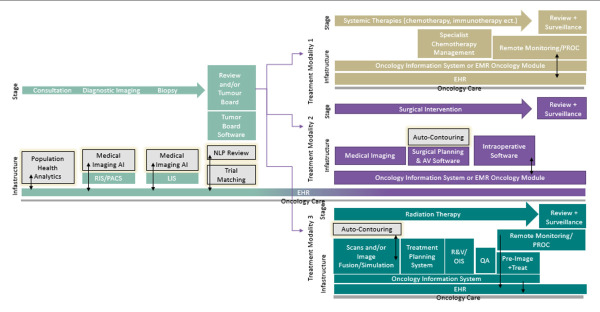

The combined Siemens-Varian oncology portfolio now encompasses most of the oncology IT workflow for providers (click image below to enlarge).

Although a few larger enterprise products are missing (LIS, EHR) Siemens-Varian now possesses broad coverage and knowledge across a range of IT products, which also allows further chances for development across several markets. Further, Siemens still retains a strong relationship with Cerner, one of the leading global EMR vendors, following the spinoff of its Soarian EMR to Cerner in 2014.

The spinoff, along with the Siemens Healthineers IPO and subsequent Varian acquisition, has been part of a long-term strategy for the firm to establish a leadership position in precision medicine. Diagnostics and therapy treatment both involve the use of medical imaging and laboratory tests to enable decisions. Now, with a complete imaging portfolio and burgeoning IVD business, the new Siemens-Varian company will be able to start combining and analyzing these results, allowing for the development of truly individualized treatment plans, care pathways and AI-enabled clinical decision support tools.

In addition, oncology care contains some of the most complex workflows present in healthcare today, with the discipline moving heavily toward multidisciplinary collaboration. As this practice develops, we expect provider focus to intensify on fixing issues within software interoperability. How Siemens and Varian approach this challenge will be key to long-term success; Siemens has traditionally been slower to move its digital capabilities toward a more consolidated and open-source platform, notably only recently announcing a roadmap to connect its imaging IT solutions together via the syngo Carbon platform. Initially this preponderance will have limited impact, such is the relatively best-of-breed approach to Oncology IT in most markets today. However, if Siemens is to realize its precision medicine aims, integration and interoperability for its broader digital portfolio will be critical to success.

Homing in on emerging markets

Integration across workflows also leads the way toward clinical pathways and tumor board development, and the company would be very well positioned to integrate information from across products. Competitors in this space are currently immature and often struggle to provide the use-case for their technology. The key challenge in this market therefore, would be replacing existing teleconferencing platforms like Microsoft and Zoom, which have no specialist capabilities but seem to have been adopted widely throughout last year as a COVID-19 solution to continuation of services. These platforms, however, do not offer benefits to workflow, nor do they facilitate access to a wide range data required for oncology care. Siemens-Varian would therefore be much better positioned to integrate and curate this information easily for providers, compared to startup vendors.

However, we do not think this focus on end-to-end oncology management signals a wider move in the market toward “closed” proprietary software provision. Providers themselves see the benefit in interoperability and vendor neutrality, and are increasingly frustrated by complex integrations. Oncology sits at the convergence of many major departmental and enterprise IT systems, and historically has seen a healthy demand for neutral best-of-breed solutions, such as those provided by vendors like RaySearch Laboratories. RaySearch Laboratories itself has begun some progress in larger academic and cancer centers, through focusing on the provision of AI-enabled software to improve provision across a range of parameters. Navigating this balance between best-of-breed capability and singular platform interoperability and customer retention will be a challenging tightrope to navigate for the firm in oncology, let alone across broader acute provider diagnostics. However, expertise and a strong position in many of the core product segments should provide the firm with an advantage in terms of navigating core customer transition from stand-alone point solutions toward broader integrated platforms.

Product development across a plethora of data

Smaller competitors and startups will also see increased competition develop as Siemens-Varian begins to expand its provision across the oncology IT workflow following the acquisition.

Siemens Healthineers has previously been quoted as intending to “leverage AI-assisted analytics to advance the development and delivery of data-driven precision care and redefine cancer diagnosis, care delivery and post-treatment survivorship.” As demonstrated in Figure 1, there are many points to apply this. Varian has already announced a partnership with Microsoft, designed to develop its own AI-based auto-contouring solution, and further interest in adaptive radiotherapy and oncology analytics can be expected. This does, however, offer vendors like Mirada Medical a reduced pool of potential partners, which will make scaling solutions much harder for small best-of-breed software vendors.

Furthermore, Siemens has also been working with recent Microsoft acquisition Nuance on workflow and integration for its AI-tools in radiology for seamless integration of results from its advanced visualization into Cerner’s EMR. With a vast pool of resources and data available across its newly formed organization to train algorithms, we expect further announcements in terms of new partnerships and integrations of AI-analysis tools and AI-enabled care pathway tools.

Outside of AI, other key areas of focus for the two vendors will likely include clinical outcome improvements through solutions designed to enable patient-reported outcome measurements and engagement. This opens the door to several other markets as vendors in the space are seeing interest, and revenue, from pharmaceutical vendors engaged in drug development. By providing PROMs, companies can help supplement the therapeutic development process, helping to steer therapy towards even more personalized development.

Entry into the C-suite for Varian Medical

Further benefits in integration will be clear for customers when negotiating multimodality sales. With the acquisition, Varian Medical can now participate in sales discussions at the C-Suite level, which could offer much larger deals with providers. This will both enable the company to outcompete other vendors with bundled pricing, while also opening the door to long-term managed service contracts.

Historically, this characteristic has been present in Siemen’s own focus in recent years on large, managed service contracts for medical imaging. To providers in today’s market, this ability to streamline complex supply chains and rely on larger partners to provide more of its modalities, software and service in long-term contracts will be looking an increasingly attractive way to reduce cost and improve efficiency across larger healthcare systems.

Varian has seen its own coverage of the specialized oncology information system (OIS) market falter in recent years, as hospitals started to digitalize patient records and larger businesses like Epic and Cerner expanded coverage to specialized oncology modules. While these solutions are not designed to cover radiation oncology management, they can provide software for the medical oncology workflow. Decisions to adopt these EMR-based clinical module solutions occur at the C-suite level, where cost savings and contract consolidation can be a more prominent concern over retaining established legacy "best of breed" clinical systems like OIS. However, ongoing competition between EMR vendors and specialist oncology software vendors is likely to remain predominantly in the surgical and chemotherapy management applications, as EMR vendors seem unlikely to develop their own internal radiation oncology solutions.

Conclusion

Assuming minimal difficulties with integration, solving interoperability challenges mid-term, and a relatively short transition period, it is already clear Varian will likely benefit from its new home as part of Siemens Healthineers.

Despite COVID-19’s challenging economic legacy, the deal also poses a promising future to providers regarding the wider development of Oncology IT, offering the choice to use one vendor for almost all oncology solutions. How quickly providers shift toward this approach remains uncertain, though current momentum toward consolidated deals for large acute providers suggest this shift is on the horizon.

Competitors in the oncology IT space should take the move as a prompt to start investing in the cohesive provision of oncology care management; whereas competing larger healthcare technology vendors may question if now they should be broadening their own scope across disciplinary workflows. This may prompt more aggressive strategic moves in the sector, either via acquisition of key vendor or technology assets from major healthcare technology vendors, or closer-knit partnerships between competitors of Siemens-Varian to offer a more complete solution set to compete with the new broad oncology offering at the firm. With a new era of precision medicine beckoning as technology evolves, it’s clear that the oncology IT segment will be entering a new, digital phase. Siemens has bet big with the Varian deal that having most technology assets under one roof is the way forward — whether this pays off for the firm is not yet clear, but we believe first-mover advantage and its leadership position in other allied sectors gives the deal a good chance of success.

About the author: Imogen Fitt is a market analyst for Signify Research, an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Signify's major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, U.K.

Siemens Healthineers officially completed the acquisition of Varian Medical Systems on April 15, 2021. The two companies constitute a combined annual revenue of around $20 billion, and there’s little doubt that this decision will have raised eyebrows amongst competitors in the oncology segment when it was announced back in August 2020.

With the process now complete, in this article we explore how this move will shape the oncology IT landscape going forward and our expectations for the new expanded Siemens Healthineers.

Building better

Siemens and Varian have been working together since 2012, when the “EnVision” partnership was first established between the two vendors. Solutions such as ARIA connectivity, which enabled Varian’s IT networks to integrate seamlessly with Siemens discontinued linear accelerators, were co-developed. The partnership initially positioned both companies positively, by providing enhanced sales opportunities for new Varian hardware and software deals once linear accelerator replacements were due. This past familiarity should also translate to a relatively smooth transition going forward, though as ever with large corporate mergers of this scale, it will take time for the two firms to realize the benefits of the deal.

Both vendors will be keen to exploit the merger allowing Varian access to Siemens’ much larger operational and sale networks, particularly a broader reach across emerging markets where Siemens already has an established presence, especially in emerging Eastern Europe, Middle East, Africa and Asia Pacific markets. In more established markets, the firms are also complementary, with little overlap of Siemens’ own installed base of established customers across Europe and Varian’s strong customer base in the U.S.

Establishing a cancer care continuum

The combined Siemens-Varian oncology portfolio now encompasses most of the oncology IT workflow for providers (click image below to enlarge).

Although a few larger enterprise products are missing (LIS, EHR) Siemens-Varian now possesses broad coverage and knowledge across a range of IT products, which also allows further chances for development across several markets. Further, Siemens still retains a strong relationship with Cerner, one of the leading global EMR vendors, following the spinoff of its Soarian EMR to Cerner in 2014.

The spinoff, along with the Siemens Healthineers IPO and subsequent Varian acquisition, has been part of a long-term strategy for the firm to establish a leadership position in precision medicine. Diagnostics and therapy treatment both involve the use of medical imaging and laboratory tests to enable decisions. Now, with a complete imaging portfolio and burgeoning IVD business, the new Siemens-Varian company will be able to start combining and analyzing these results, allowing for the development of truly individualized treatment plans, care pathways and AI-enabled clinical decision support tools.

In addition, oncology care contains some of the most complex workflows present in healthcare today, with the discipline moving heavily toward multidisciplinary collaboration. As this practice develops, we expect provider focus to intensify on fixing issues within software interoperability. How Siemens and Varian approach this challenge will be key to long-term success; Siemens has traditionally been slower to move its digital capabilities toward a more consolidated and open-source platform, notably only recently announcing a roadmap to connect its imaging IT solutions together via the syngo Carbon platform. Initially this preponderance will have limited impact, such is the relatively best-of-breed approach to Oncology IT in most markets today. However, if Siemens is to realize its precision medicine aims, integration and interoperability for its broader digital portfolio will be critical to success.

Homing in on emerging markets

Integration across workflows also leads the way toward clinical pathways and tumor board development, and the company would be very well positioned to integrate information from across products. Competitors in this space are currently immature and often struggle to provide the use-case for their technology. The key challenge in this market therefore, would be replacing existing teleconferencing platforms like Microsoft and Zoom, which have no specialist capabilities but seem to have been adopted widely throughout last year as a COVID-19 solution to continuation of services. These platforms, however, do not offer benefits to workflow, nor do they facilitate access to a wide range data required for oncology care. Siemens-Varian would therefore be much better positioned to integrate and curate this information easily for providers, compared to startup vendors.

However, we do not think this focus on end-to-end oncology management signals a wider move in the market toward “closed” proprietary software provision. Providers themselves see the benefit in interoperability and vendor neutrality, and are increasingly frustrated by complex integrations. Oncology sits at the convergence of many major departmental and enterprise IT systems, and historically has seen a healthy demand for neutral best-of-breed solutions, such as those provided by vendors like RaySearch Laboratories. RaySearch Laboratories itself has begun some progress in larger academic and cancer centers, through focusing on the provision of AI-enabled software to improve provision across a range of parameters. Navigating this balance between best-of-breed capability and singular platform interoperability and customer retention will be a challenging tightrope to navigate for the firm in oncology, let alone across broader acute provider diagnostics. However, expertise and a strong position in many of the core product segments should provide the firm with an advantage in terms of navigating core customer transition from stand-alone point solutions toward broader integrated platforms.

Product development across a plethora of data

Smaller competitors and startups will also see increased competition develop as Siemens-Varian begins to expand its provision across the oncology IT workflow following the acquisition.

Siemens Healthineers has previously been quoted as intending to “leverage AI-assisted analytics to advance the development and delivery of data-driven precision care and redefine cancer diagnosis, care delivery and post-treatment survivorship.” As demonstrated in Figure 1, there are many points to apply this. Varian has already announced a partnership with Microsoft, designed to develop its own AI-based auto-contouring solution, and further interest in adaptive radiotherapy and oncology analytics can be expected. This does, however, offer vendors like Mirada Medical a reduced pool of potential partners, which will make scaling solutions much harder for small best-of-breed software vendors.

Furthermore, Siemens has also been working with recent Microsoft acquisition Nuance on workflow and integration for its AI-tools in radiology for seamless integration of results from its advanced visualization into Cerner’s EMR. With a vast pool of resources and data available across its newly formed organization to train algorithms, we expect further announcements in terms of new partnerships and integrations of AI-analysis tools and AI-enabled care pathway tools.

Outside of AI, other key areas of focus for the two vendors will likely include clinical outcome improvements through solutions designed to enable patient-reported outcome measurements and engagement. This opens the door to several other markets as vendors in the space are seeing interest, and revenue, from pharmaceutical vendors engaged in drug development. By providing PROMs, companies can help supplement the therapeutic development process, helping to steer therapy towards even more personalized development.

Entry into the C-suite for Varian Medical

Further benefits in integration will be clear for customers when negotiating multimodality sales. With the acquisition, Varian Medical can now participate in sales discussions at the C-Suite level, which could offer much larger deals with providers. This will both enable the company to outcompete other vendors with bundled pricing, while also opening the door to long-term managed service contracts.

Historically, this characteristic has been present in Siemen’s own focus in recent years on large, managed service contracts for medical imaging. To providers in today’s market, this ability to streamline complex supply chains and rely on larger partners to provide more of its modalities, software and service in long-term contracts will be looking an increasingly attractive way to reduce cost and improve efficiency across larger healthcare systems.

Varian has seen its own coverage of the specialized oncology information system (OIS) market falter in recent years, as hospitals started to digitalize patient records and larger businesses like Epic and Cerner expanded coverage to specialized oncology modules. While these solutions are not designed to cover radiation oncology management, they can provide software for the medical oncology workflow. Decisions to adopt these EMR-based clinical module solutions occur at the C-suite level, where cost savings and contract consolidation can be a more prominent concern over retaining established legacy "best of breed" clinical systems like OIS. However, ongoing competition between EMR vendors and specialist oncology software vendors is likely to remain predominantly in the surgical and chemotherapy management applications, as EMR vendors seem unlikely to develop their own internal radiation oncology solutions.

Conclusion

Assuming minimal difficulties with integration, solving interoperability challenges mid-term, and a relatively short transition period, it is already clear Varian will likely benefit from its new home as part of Siemens Healthineers.

Despite COVID-19’s challenging economic legacy, the deal also poses a promising future to providers regarding the wider development of Oncology IT, offering the choice to use one vendor for almost all oncology solutions. How quickly providers shift toward this approach remains uncertain, though current momentum toward consolidated deals for large acute providers suggest this shift is on the horizon.

Competitors in the oncology IT space should take the move as a prompt to start investing in the cohesive provision of oncology care management; whereas competing larger healthcare technology vendors may question if now they should be broadening their own scope across disciplinary workflows. This may prompt more aggressive strategic moves in the sector, either via acquisition of key vendor or technology assets from major healthcare technology vendors, or closer-knit partnerships between competitors of Siemens-Varian to offer a more complete solution set to compete with the new broad oncology offering at the firm. With a new era of precision medicine beckoning as technology evolves, it’s clear that the oncology IT segment will be entering a new, digital phase. Siemens has bet big with the Varian deal that having most technology assets under one roof is the way forward — whether this pays off for the firm is not yet clear, but we believe first-mover advantage and its leadership position in other allied sectors gives the deal a good chance of success.

About the author: Imogen Fitt is a market analyst for Signify Research, an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Signify's major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, U.K.